An Update on the Refrigerant Landscape

By Georg Fösel

Manager for Refrigeration Technology and Industry Affairs

The selection of refrigerants is core to system design, achievable efficiency, and the overall carbon footprint of refrigerated machinery, such as in Reefer containers. The selection process has been regulated for more than 30 years to ensure that the environmental impact of these substances is minimized, while also ensuring the availability and safe operation of refrigeration equipment.

Today, the selection and availability of refrigerants are impacted by two major regulatory initiatives: the F-gas regulations, which follow the Kigali Amendment to the Montreal Protocol and aim to reduce greenhouse gas emissions, and the PFAS regulations, which aim to reduce pollution of soil and water.

In this article, I would like to update you on how these two initiatives are affecting refrigerants used in Reefer containers.

F-gas

China Price Increases (China Chemical Market Insights)

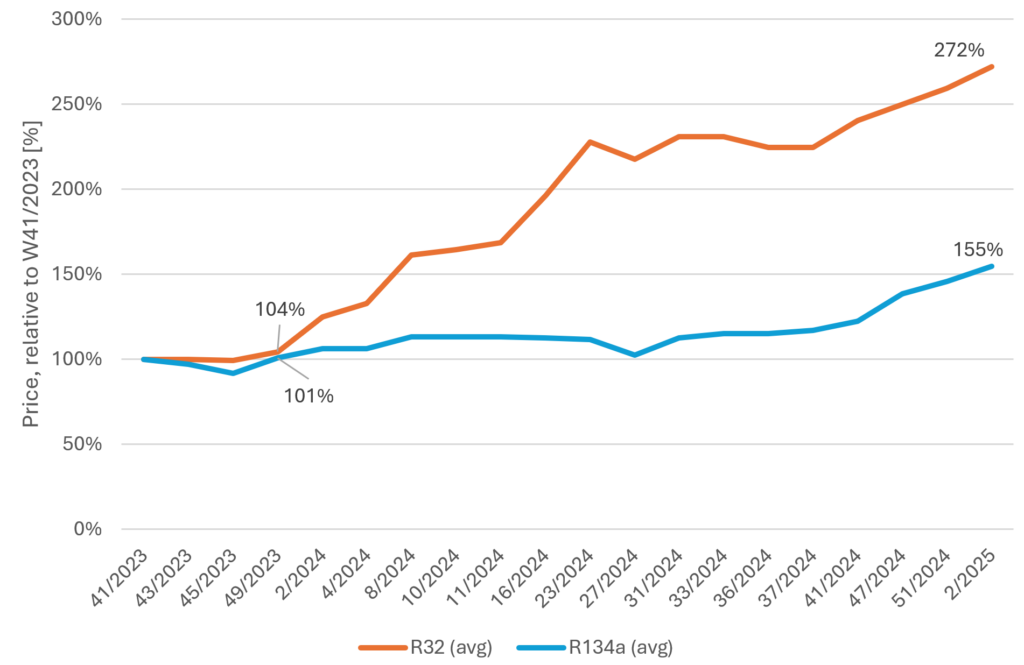

In 2024, China introduced a market cap on refrigerants, following the agreement in the Kigali Amendment. This has led to a significant increase in refrigerant prices, as the available amount of fluorinated gases was limited, while demand for refrigerants did not decline. According to data from China Chemical Market Insights, the price of R134a has increased by more than 50%. Despite having a lower GWP, the highly demanded refrigerant R32 saw its price nearly triple, as it is a popular alternative in air conditioning and heat pump systems, such as window split or VRF systems, replacing R410A. While China is set to reduce the quota of fluorinated substances to 90% of current levels by 2029, we can expect continuous price increases on all regulated refrigerants—especially those with high demand.

Figure 1: Data from China Chemical Market Insights

New US Regulations for Intermodal Refrigeration

2025 is also the year when the EPA’s Technology Transitions Program will restrict the use of climate-damaging hydrofluorocarbons (HFCs) in various sectors. Among other things, intermodal containers imported to the US will need to operate with a refrigerant that has a GWP of 700 or less. Exceptions exist only for ultra-low temperature products operating with temperatures below -50°C.

On Jan 17th, the EPA issued a No Action Assurance Letter, which indicates that equipment designed to achieve box temperatures below -35°C will not need to comply to the 700 limit, but rather use a refrigerant with a GWP at or below 2140. This exception remains valid until Jan 1st 2026 or until a new proposed rule is finalized.

This means that R134a will no longer be an option for this market, but compliance can be ensured with refrigerants like R513A or R1234yf.

PFAS

PFAS is an abbreviation for per- and polyfluoroalkyl substances, a large group of more than 12,000 substances used in many applications, such as nonstick cookware, clothing, refrigerants, and gaskets, due to their resistance to challenging conditions like heat, oil, and water. PFAS are essential in today’s Reefer container products, as all commonly used refrigerants—R134a, R513A, and R1234yf—are classified as PFAS by their chemical structure.

The European Chemicals Agency (ECHA) has been tasked with reviewing a universal PFAS restriction proposal and is currently evaluating the risks and socio-economic impacts of PFAS on a per-use basis.

The Container Owner Association (COA) has expressed concerns about the proposed PFAS restrictions in the EU. They emphasize the need for a balanced approach that considers the critical uses of PFAS in industrial applications. The COA highlights the potential economic impacts and the importance of ensuring that any restrictions are practical and enforceable. They have recommended, at a minimum, an extended derogation period, allowing Reefers to operate with fluorinated gases well into the 2040s. This would provide sufficient time to safely transition to a new refrigerant platform that does not compromise system efficiency or fuel consumption needed to power the Reefers.

EU

- In 2025, we can expect that fluorinated gases (i.e., refrigerants) will be reviewed by the ECHA’s Committee for Risk Assessment (RAC) and Committee for Socio-Economic Analysis (SEAC). These sessions are tentatively scheduled for March, but we will likely not gain insight into the provisional conclusions before all remaining applications are reviewed. No concrete date has been announced, but it is unlikely that this will occur before Q3/Q4 2025.

- At the end of the restriction proposal review process, ECHA will make recommendations to the European Commission. Political influence is expected to be seen at this stage, and recent reporting published by the “Forever Lobbying Project” indicates a tendency toward a watered-down regulation. For instance, Germany—an original restriction proposal filing member—is backing off from the initial idea of a universal restriction proposal. This, seen in light of the recent elections and the possible new government, will ensure that 2025 remains an interesting year to observe the PFAS debate.

Link: Kampf um PFAS: Wie Habeck der Chemie-Lobby auf den Leim geht | tagesschau.de

US

- On a federal level, the EPA’s position remains clear and unchanged: refrigerants and TFA (trifluoroacetic acid) do not represent PFAS and will not be targeted in any regulatory actions. However, the state of Maine has passed a bill that will prevent the sale of fluorinated refrigerants from 2040 onwards, either contained in equipment or as products themselves, in the state. Exceptions exist for service and second-hand use.

Summary and Outlook

The actions to reduce greenhouse gas emissions make it clear that an alternative to R134a is needed. R1234yf is the ideal replacement candidate due to material compatibility, capacity/efficiency match with existing equipment, and low operational risk. Additionally, it offers the potential to reduce emissions by 1 ton of CO2 equivalent per year per reefer without jeopardizing efficiency, thus reducing greenhouse gas emissions from power generation. Also, commercially, this alternative will become more attractive as prices for R134a continue to rise.

While we can be less certain about the outcome of PFAS regulations, developments in Europe and the United States do not suggest any short-term implementation of additional regulations that could affect the selection and adaptation of R1234yf.

With R1234yf being adopted in the Reefer industry, we have the opportunity to safely migrate to a more climate-friendly solution, while gradually educating technicians around the world on the safe use of flammable refrigerants. This will pave the way for alternatives that match or exceed current levels of energy efficiency.